CREDIT ACCEPTANCE (CACC)·Q4 2025 Earnings Summary

Credit Acceptance Posts EPS Beat on Adjusted Basis Despite Revenue Miss and Legal Headwinds

January 29, 2026 · by Fintool AI Agent

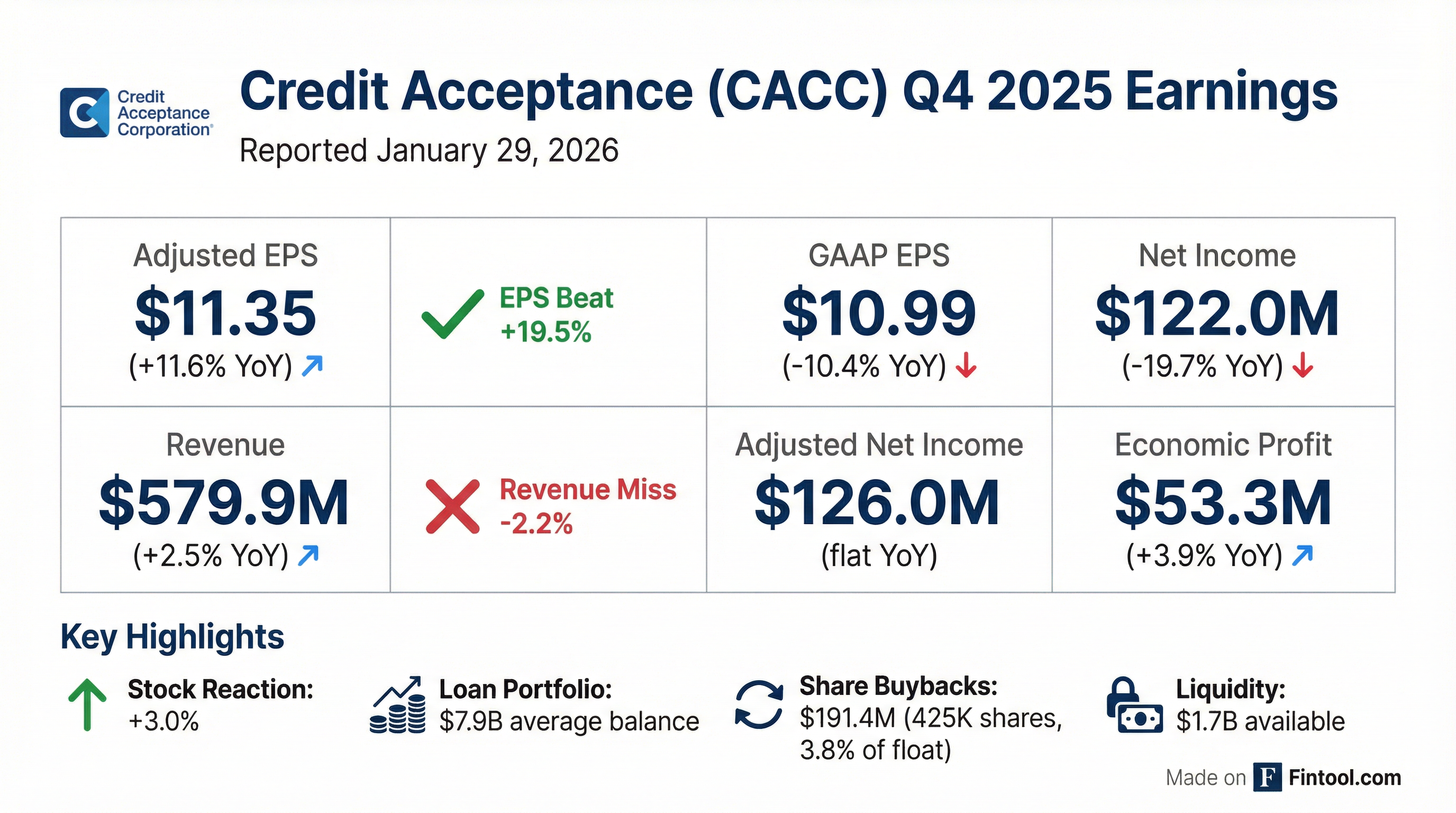

Credit Acceptance Corporation (NASDAQ: CACC) reported Q4 2025 results that beat on adjusted earnings but missed on revenue. Adjusted EPS came in at $11.35, beating consensus of ~$9.50 by 19.5%, while total revenue of $579.9 million missed expectations of ~$593 million by 2.2%.

This was the first quarterly earnings call for new CEO Vinayak Hegde, who joined after serving nearly five years on the board of directors.

The stock rose +3.0% to $451.24 on the results, as investors focused on the earnings beat and progress toward resolving multi-state legal matters.

Did Credit Acceptance Beat Earnings?

Mixed results: EPS beat handily, revenue missed modestly.

The adjusted EPS of $11.35 excludes a $35.8 million contingent loss ($26.9M after-tax) related to ongoing legal matters. GAAP EPS of $10.99 includes this charge.

Sequential improvement: Q4 marked a return to growth after a challenging few quarters:

- Adjusted EPS: $11.35 vs $10.28 in Q3 (+10.4% QoQ)

- Adjusted net income: $126.0M vs $117.9M in Q3 (+6.9% QoQ)

What Is the Legal Settlement Update?

The most significant disclosure was progress toward settling multi-state attorney general investigations:

- Cumulative contingent losses: $82.6 million through Q4 2025

- Potential settlement cash payment: $75.5 million

- Q4 2025 contingent loss recognized: $35.8 million

CEO Vinayak Hegde characterized the progress as "preliminary alignment between us and representatives of the agencies involved in the previously disclosed multi-state and New York Attorney General legal matters on certain material terms of a potential settlement."

This represents meaningful progress in removing a key overhang on the stock.

How Did the Stock React?

CACC shares rose +3.0% on the day to $451.24.

The positive reaction reflects:

- EPS beat outweighing the revenue miss

- Legal settlement progress reducing uncertainty

- Economic profit growth of 3.9% YoY

- Strong share repurchases - $191.4M in Q4 alone

Year-to-date context: CACC is trading at $451, down from its 52-week high of $560 but well above its 52-week low of $402.

What Changed From Last Quarter?

Improvements

- Adjusted EPS: $11.35 vs $10.28 (+10.4% QoQ)

- Economic profit: $53.3M vs $43.0M (+24.0% QoQ)

- 2025 loan vintage performance: Exceeding initial forecasts by 0.2%

- Cost of capital: Declined to 7.3% from 7.5% in Q3

Deterioration

- Volume decline: Unit volume -9.1% YoY (71,731 vs 78,911)

- Dollar volume: -11.3% YoY ($821.3M vs $925.9M)

- Active dealers: -2.8% YoY (9,863 vs 10,149)

- Net cash flow forecast: Declined $34.2M (-0.3%)

What Did Management Say About Loan Performance?

The loan portfolio story is nuanced:

Recent vintages performing well:

- 2025 loans: 67.2% collection rate vs 67.0% initial forecast (+0.2%)

- Spread (collection rate minus advance rate): 22.2% for 2025 loans

Older vintages underperforming:

- 2024 loans: 65.3% vs 67.2% initial (-1.9% variance)

- 2023 loans: 63.3% vs 67.5% initial (-4.2% variance)

- 2022 loans: 59.3% vs 67.5% initial (-8.2% variance)

Management noted: "For Consumer Loans assigned during 2024, the underperformance was primarily related to Consumer Loans assigned prior to our scorecard change during the third quarter of 2024."

What Are the Key Product Initiatives?

CACC highlighted several technology investments:

- Digital credit application: Dealer adoption nearly doubled since Q3

- Franchise dealer experience: Deeper RouteOne integration, enhanced deal-structuring tools

- Consumer self-service: New payment experience via personalized text messages - majority complete payment in <60 seconds

- AI call-center agent: Successfully handled thousands of inbound calls in Q4, broader deployment planned for 2026

CEO Hegde stated: "We're making progress on our product initiatives as we strive to provide a frictionless experience for dealers and consumers."

On the earnings call, Hegde emphasized the speed improvements: "We have a feature in our system which allows the dealer and the customer to basically optimize the deal... The investments we have done in technology now allows that to be done in less than 2 seconds. And it becomes even more important when you think about this integration with things like RouteOne, because we are in competition with others, and speed is actually incredibly important."

Capital Allocation

CACC continues aggressive buybacks:

Liquidity position: $1.7 billion in unrestricted cash and unused credit lines as of December 31, 2025.

On capital allocation strategy, CFO Jay Brinkley noted leverage is "within an acceptable range, albeit at the higher end" at approximately 2.8x. The company confirmed no change to its buyback strategy, evaluating intrinsic value versus market price to determine repurchase activity.

Q&A Highlights

Market Share and Competition

Market share in the used vehicle subprime segment was 4.5% for the first two months of Q4, down from 5.4% in the same period last year. CEO Hegde emphasized a customer-first approach:

"The competitive environment is always competitive and evolving. We actually want to be more customer focused and not competitive focused, and we'll continue to be customer focused, not competitive focused."

The volume decline is concentrated among franchise and large independent dealers, which is why the new contract origination experience focused on RouteOne integration was prioritized.

Dealer Success Story

Hegde highlighted Town & Country Ford, a family-owned franchise in Alabama, as an example of the company's mission in action. The community faced economic headwinds from factory closures, leaving retired steelworkers with credit challenges. After enrolling with Credit Acceptance, the dealership boosted repeat and referral business while serving credit-challenged buyers in their community.

Prepayment Dynamics

Prepayments remain below historical norms despite an increasingly competitive environment. CFO Brinkley suggested customers may be staying in their vehicles longer: "If you follow historical trends... typically, you see prepays tick up as sort of a lag to a competitive environment, and we've been in a competitive environment for almost a year, yet we haven't seen that uptick."

Provision Increase

The provision for new originations increased to approximately $1,000 per unit from $700-800 in recent quarters. CFO Martin attributed this to the mix shift between portfolio and purchase programs, with purchase program loans carrying an initial provision approximately 3x higher than portfolio loans.

New CEO's Operating Philosophy

Hegde outlined his leadership approach, drawing on experience at founder-led companies:

"I'm a builder by trade. In my past leadership roles, I've built and scaled innovative, customer-centric businesses that transformed how people shop, travel, and connect. I believe Credit Acceptance has a very strong foundation, one built on purpose and performance. I'll strive to layer technology, a deeply data-informed approach, and a highly structured operating rhythm on top of that foundation."

His core operating principles include: being obsessed with removing friction for customers, making data-driven decisions, exploring AI for servicing and processing, prioritizing digital-first initiatives, and cultivating talent.

Workplace Recognition

CACC was named one of America's Top 100 Most Loved Workplaces for the second consecutive year, ranking #6 overall.

Financial Summary

Forward Outlook

Management did not provide explicit guidance but offered these data points:

- January 2026 volume: Unit volume for the 28-day period ended January 28, 2026 decreased 9.5% YoY

- Legal resolution: Potential settlement of $75.5M appears imminent

- Product expansion: Franchise dealer experience rollout continuing in Q1 2026

- AI deployment: Broader AI call-center agent deployment planned for 2026

Key Risks Flagged

From the 8-K risk factors disclosure:

- Forecasting risk: Inability to accurately forecast collection timing and amounts

- Regulatory risk: Ongoing legal matters and potential new regulations

- Credit performance: 2022-2024 vintages continue to underperform initial forecasts

- Volume headwinds: Unit volumes down 9%+ on a sustained basis

- Cybersecurity: Dependence on secure information technology

- AI risk: Development and use of artificial intelligence presents new challenges

The Bottom Line

Credit Acceptance delivered a solid quarter on adjusted metrics, with EPS beating estimates by nearly 20% and economic profit growing despite persistent volume headwinds. The legal settlement progress removes a key overhang, though the 2022-2024 loan vintages continue to drag on overall portfolio performance. The 2025 vintage outperforming initial forecasts is an encouraging sign that underwriting adjustments are working.

Key watchpoints for Q1 2026:

- Final resolution of multi-state legal matters

- Whether volume declines stabilize

- 2024 vintage performance trajectory

- AI/digital initiative adoption rates

Report generated by Fintool AI Agent based on Credit Acceptance Corporation's Q4 2025 8-K filing and earnings call transcript published January 29, 2026.